Redesigning the Securities-Based Line of Credit experience

design + testing + branding uplift

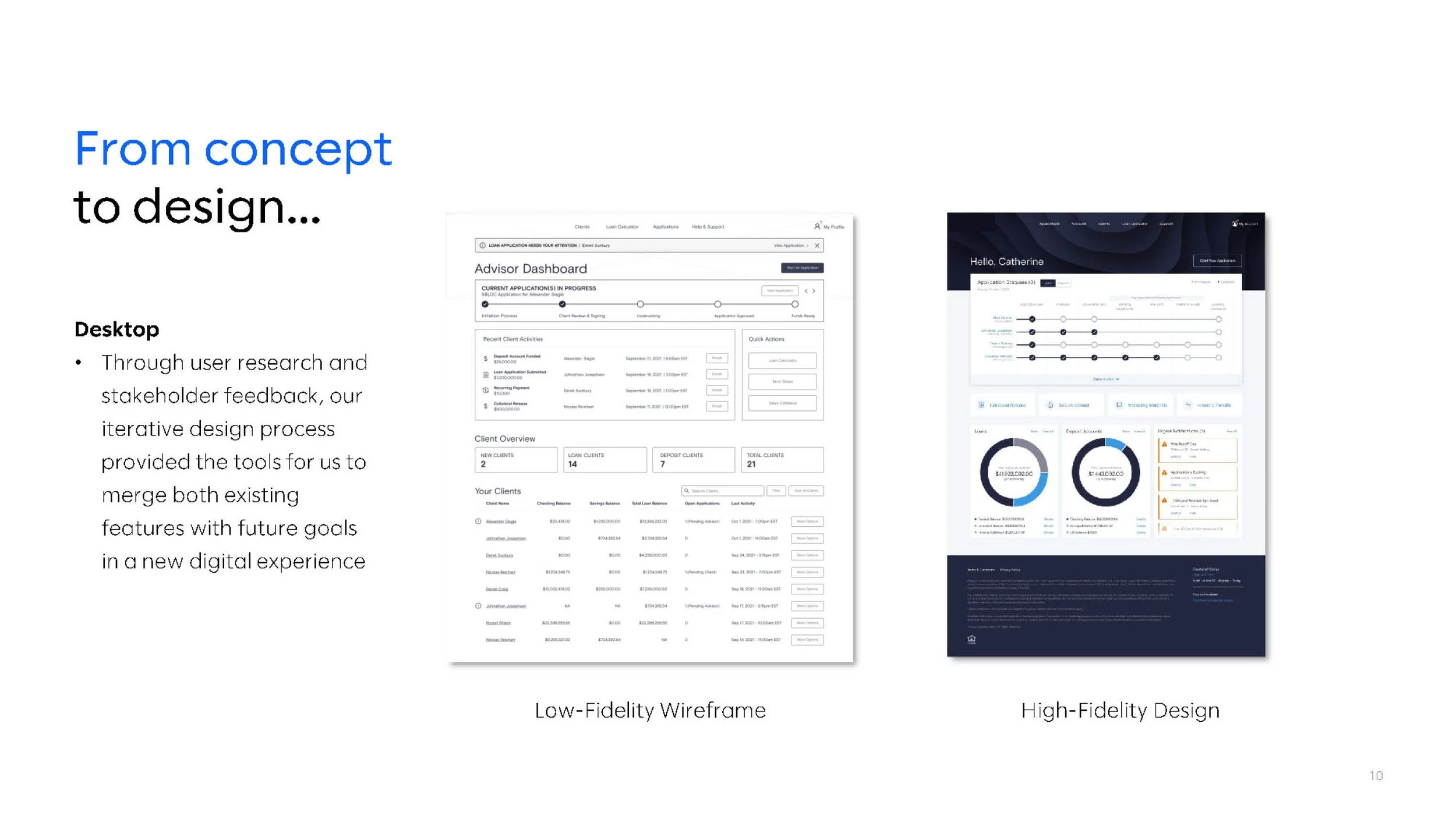

Informed by user research and stakeholder feedback, our iterative design process seamlessly integrated existing features with future objectives, resulting in a new digital experience. Our team focused on providing a seamless Line of Credit application process for the firm's clients and financial advisors. Additionally, we created a cohesive experience for newly added account types and actions, including money movement.

Client

Global Investment Banking & Private Wealth Management Firm

Collaborators

Product sponsors

Product owners

Tech/Dev team

Financial Advisors & internal agents acting as end-user proxies for high net worth & ultra high net worth individuals

Work at a high-level

-

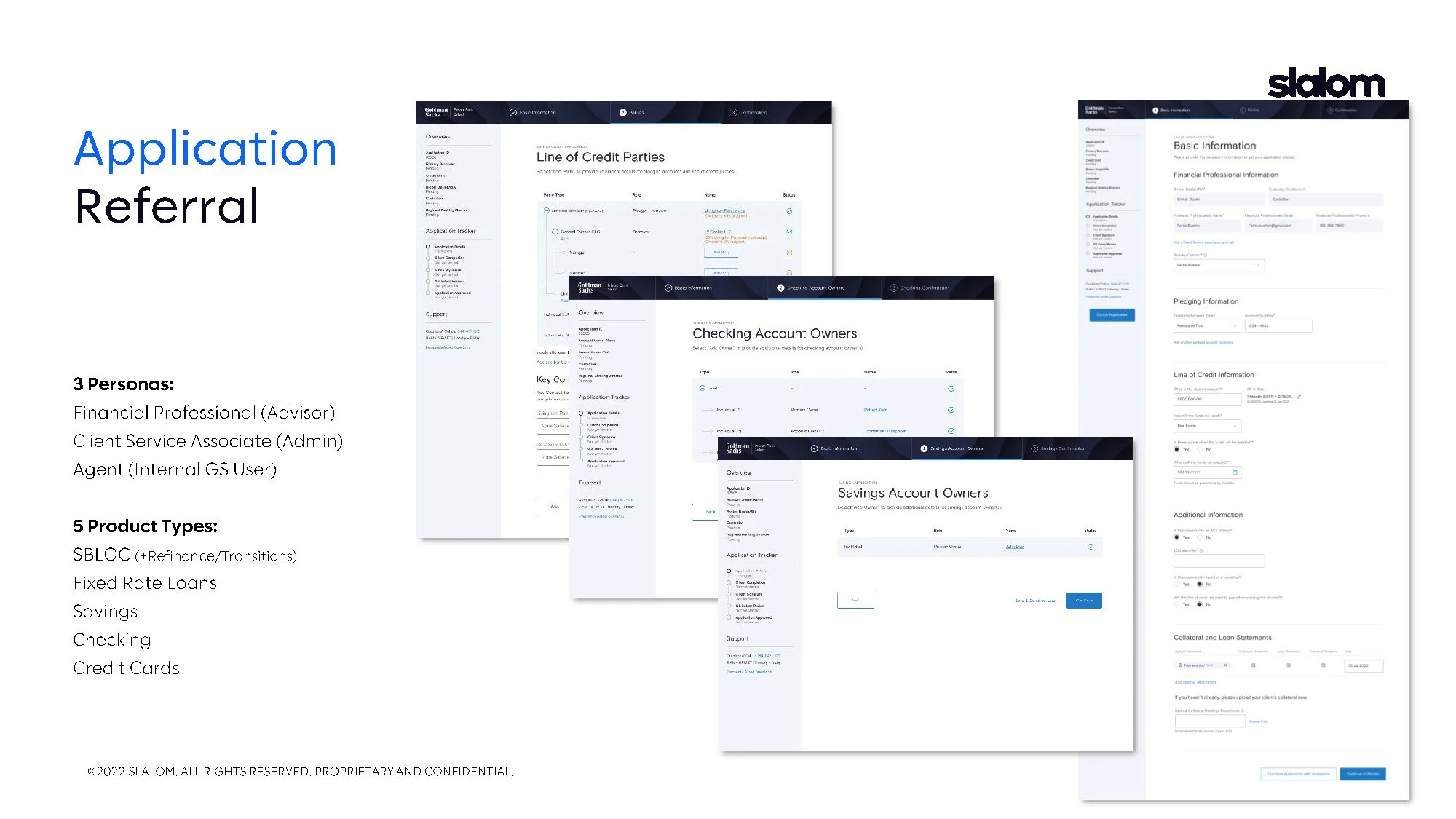

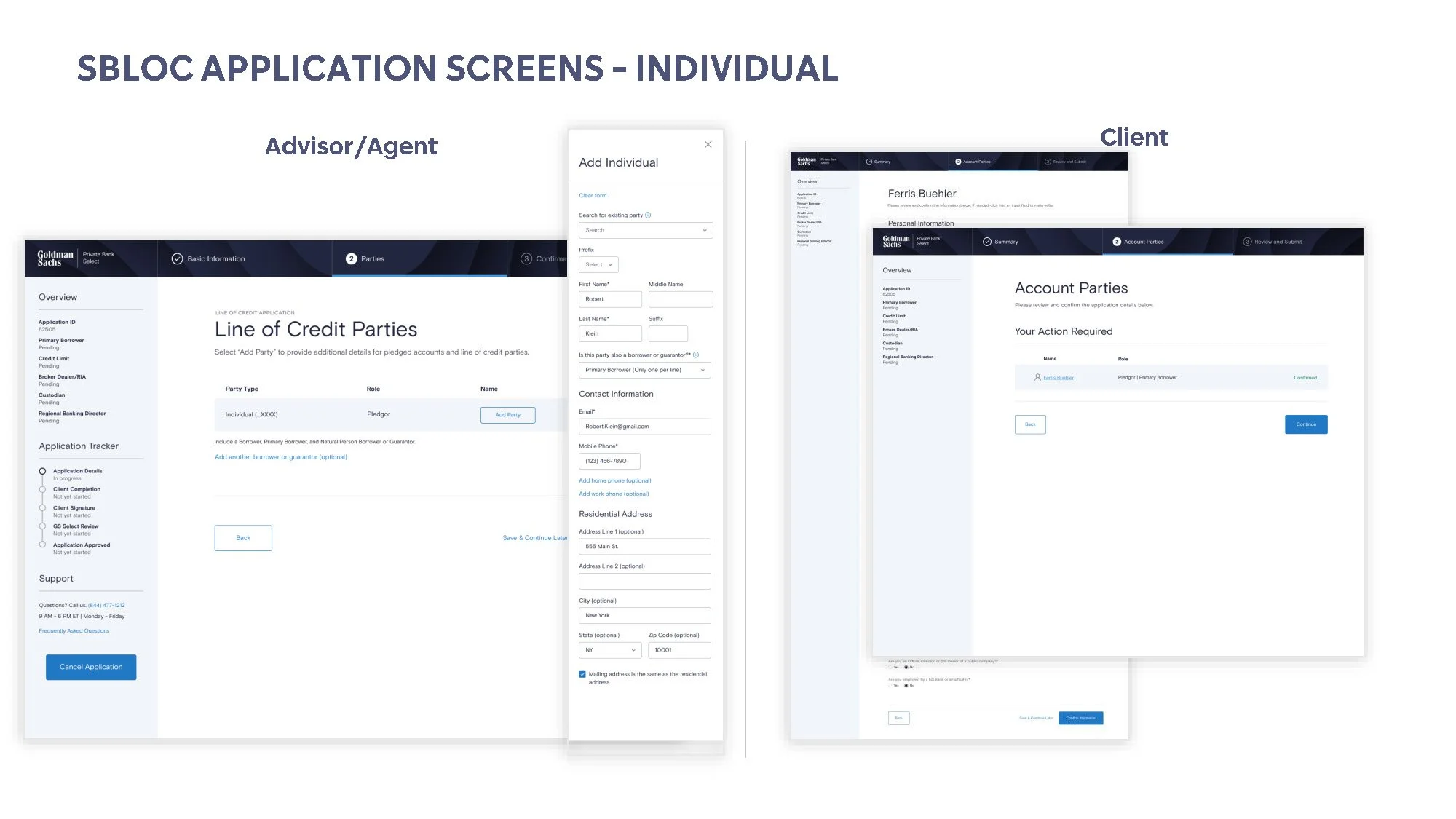

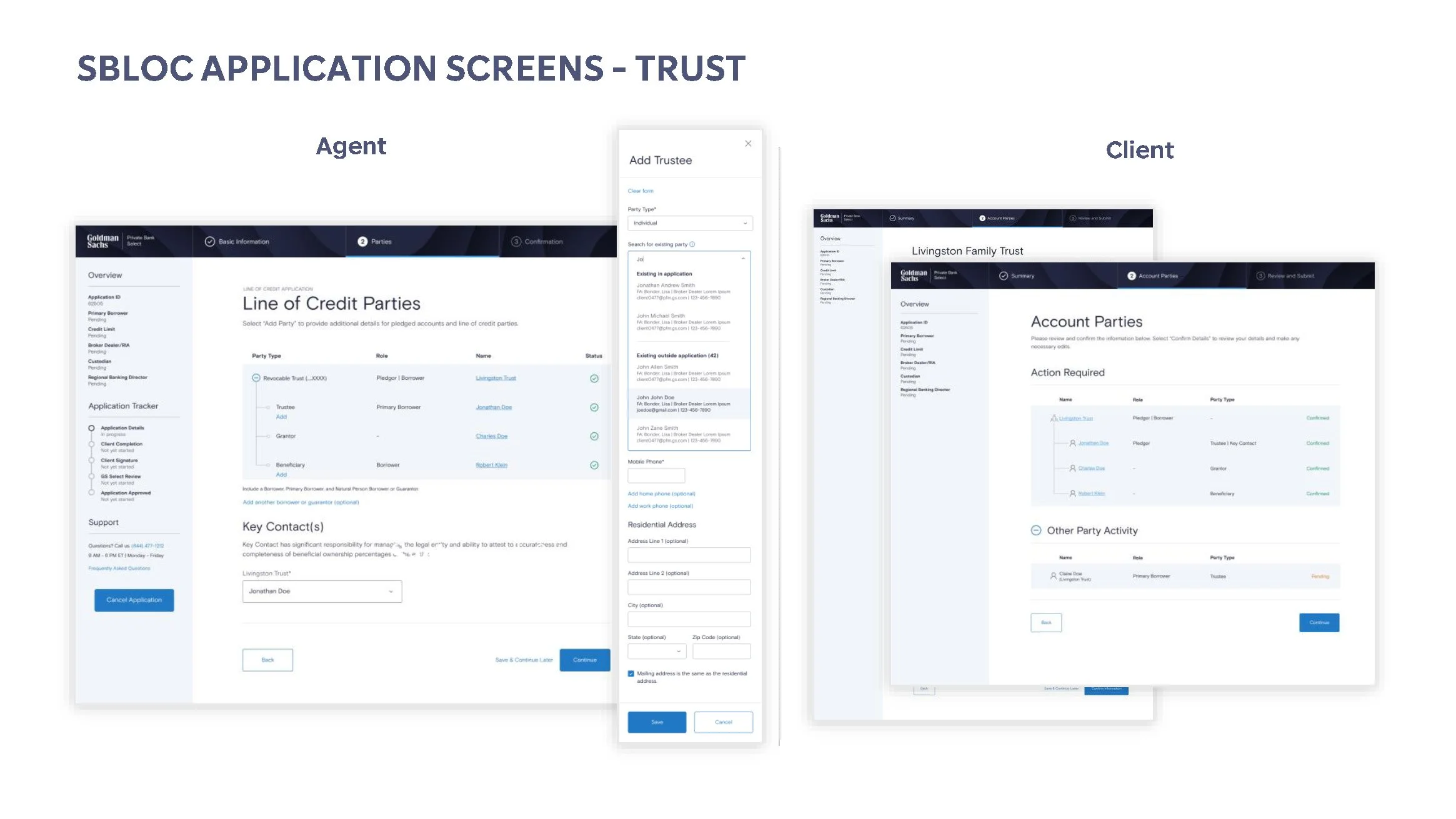

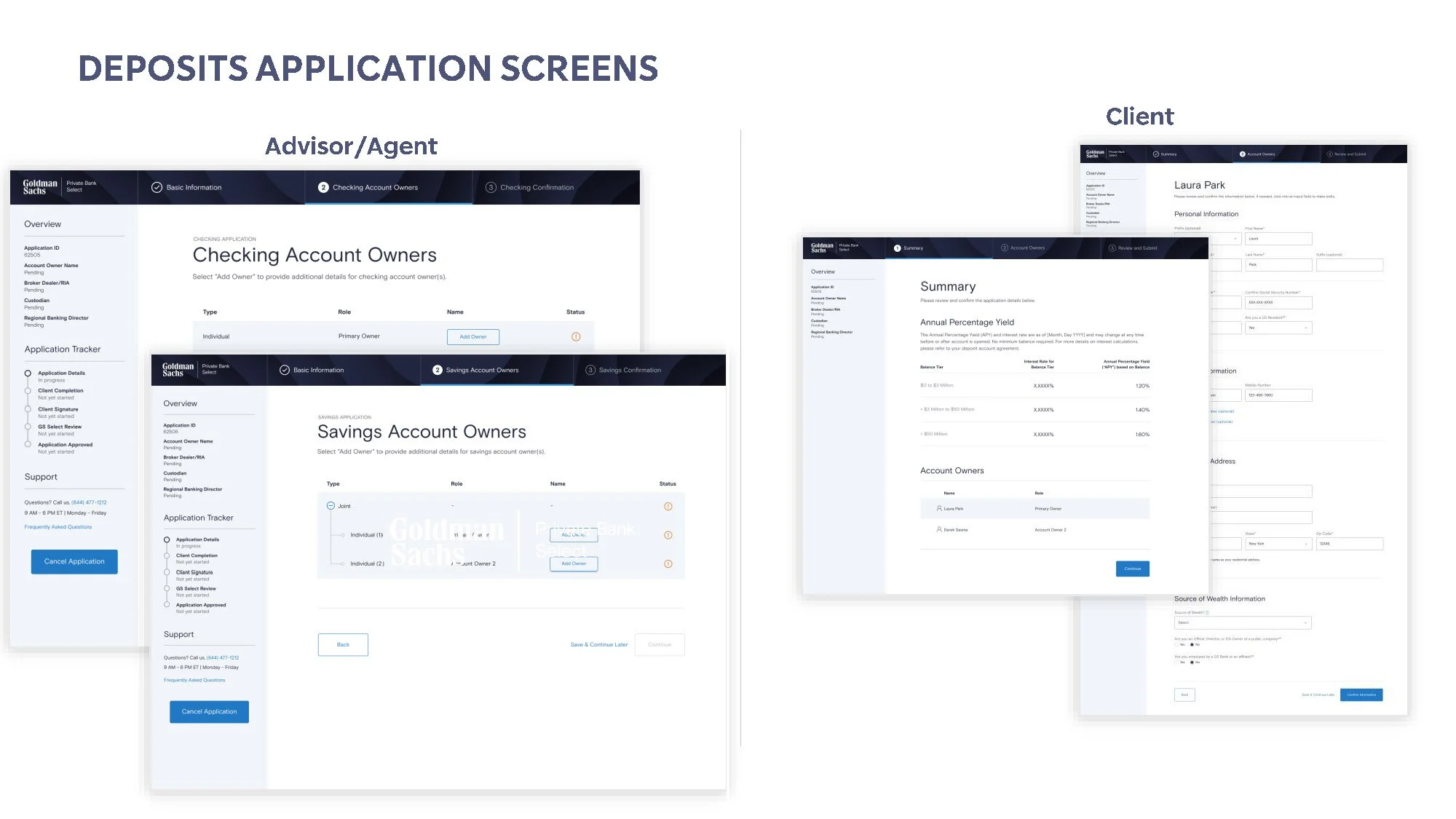

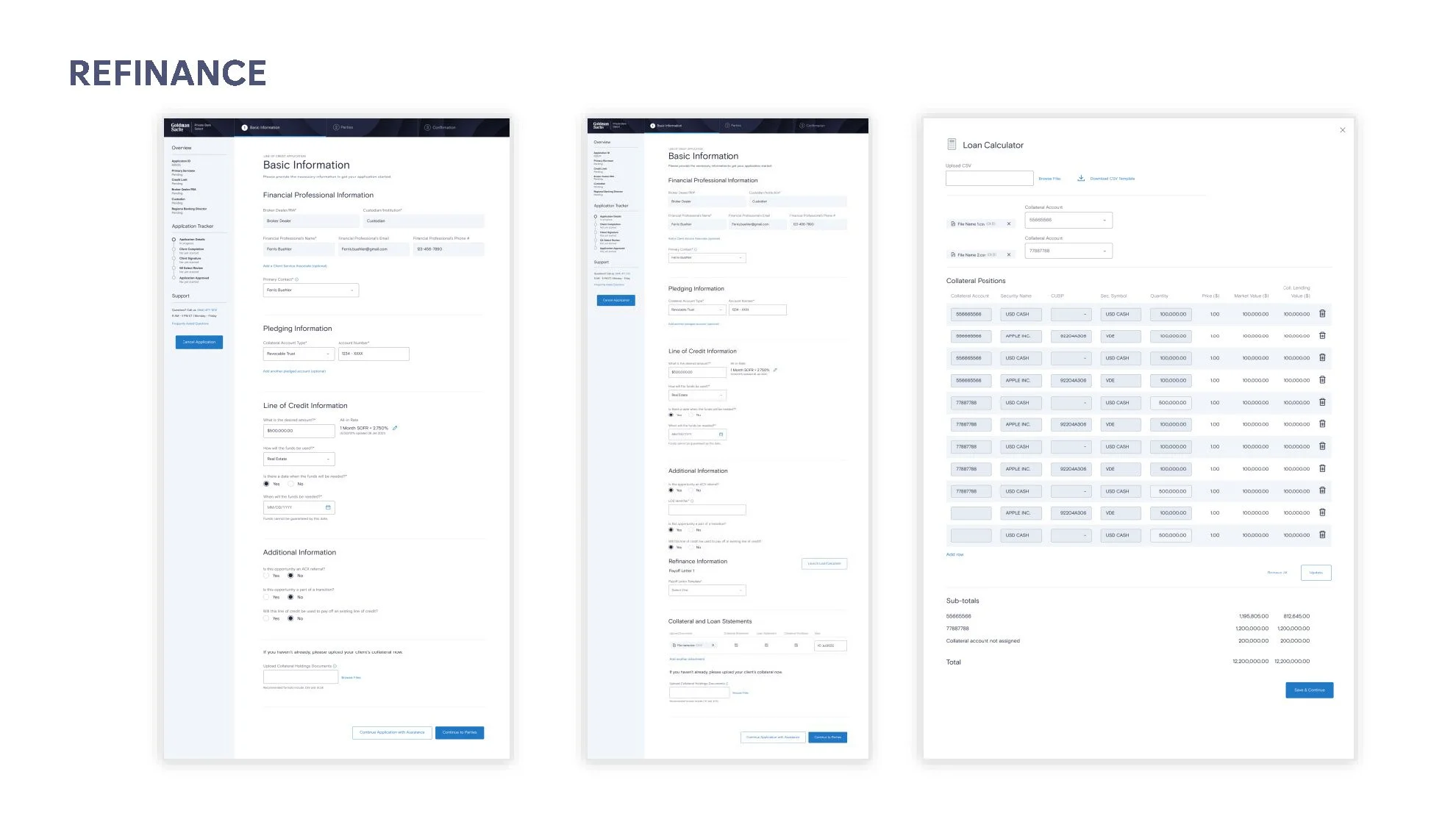

Line of Credit Application Experience [Advisor & Client]

To efficiently present Line of Credit (LOC) structures, we implemented a tree diagram structure designed to accommodate even the most intricate LOC configurations. This structure allows users to input and edit information as required, with different data entry points tailored to specific user entitlements.

Our primary focus was to ensure that users can effortlessly navigate and complete online applications independently, eliminating the need for advisor assistance. This self-service approach, while promoting user autonomy, still maintains a premium, white-glove experience, ensuring that users feel supported and guided throughout the process.

-

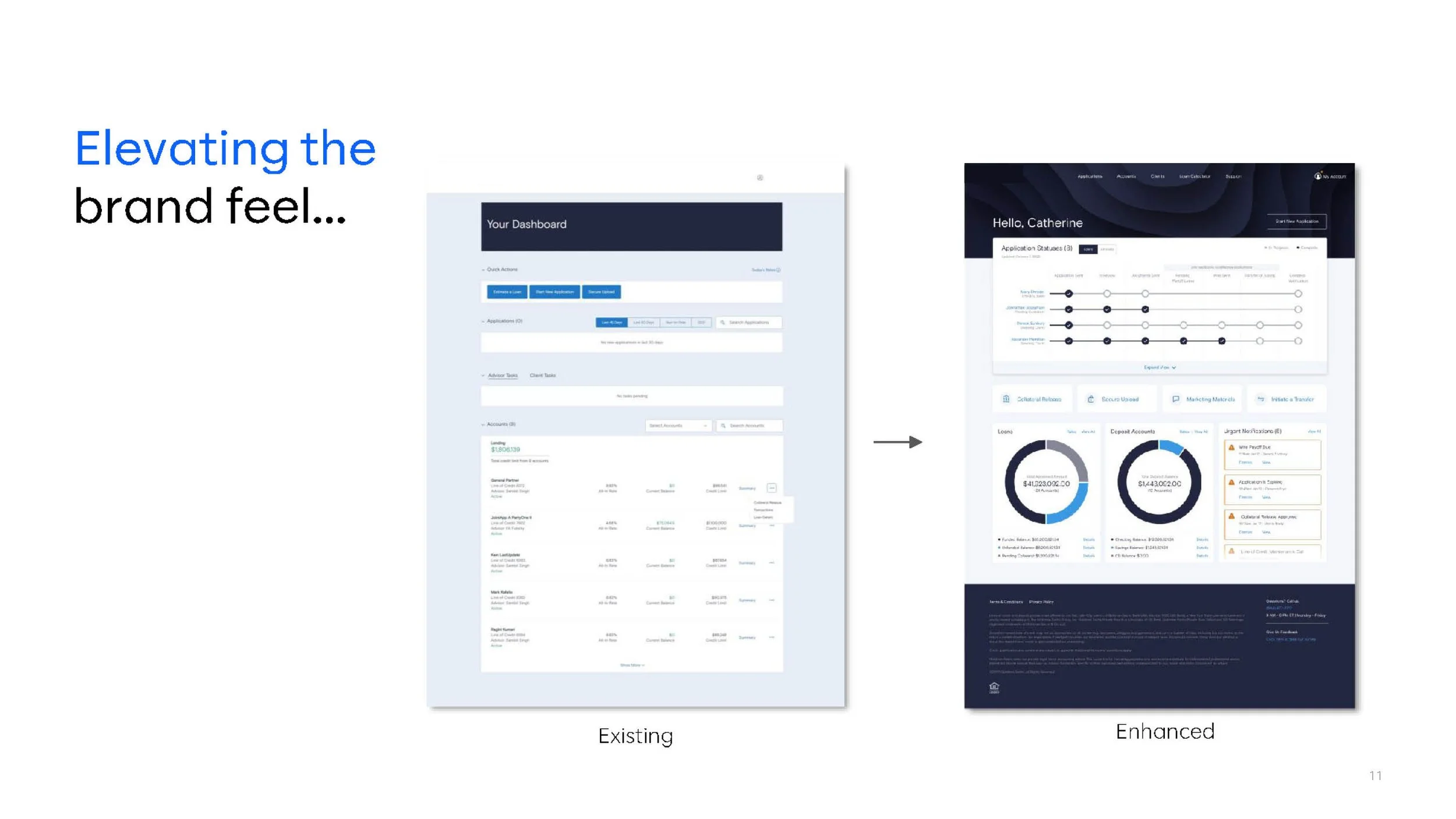

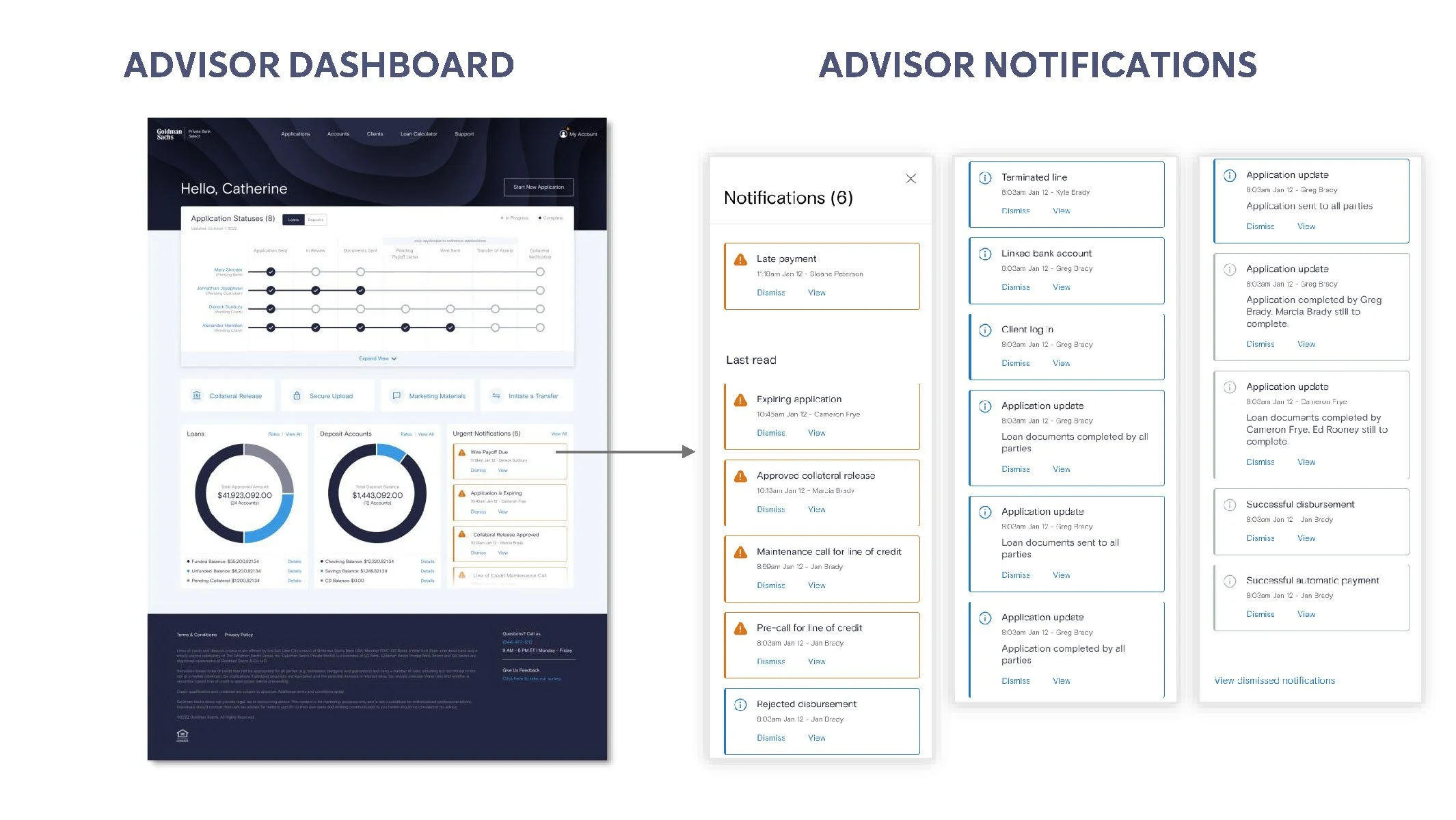

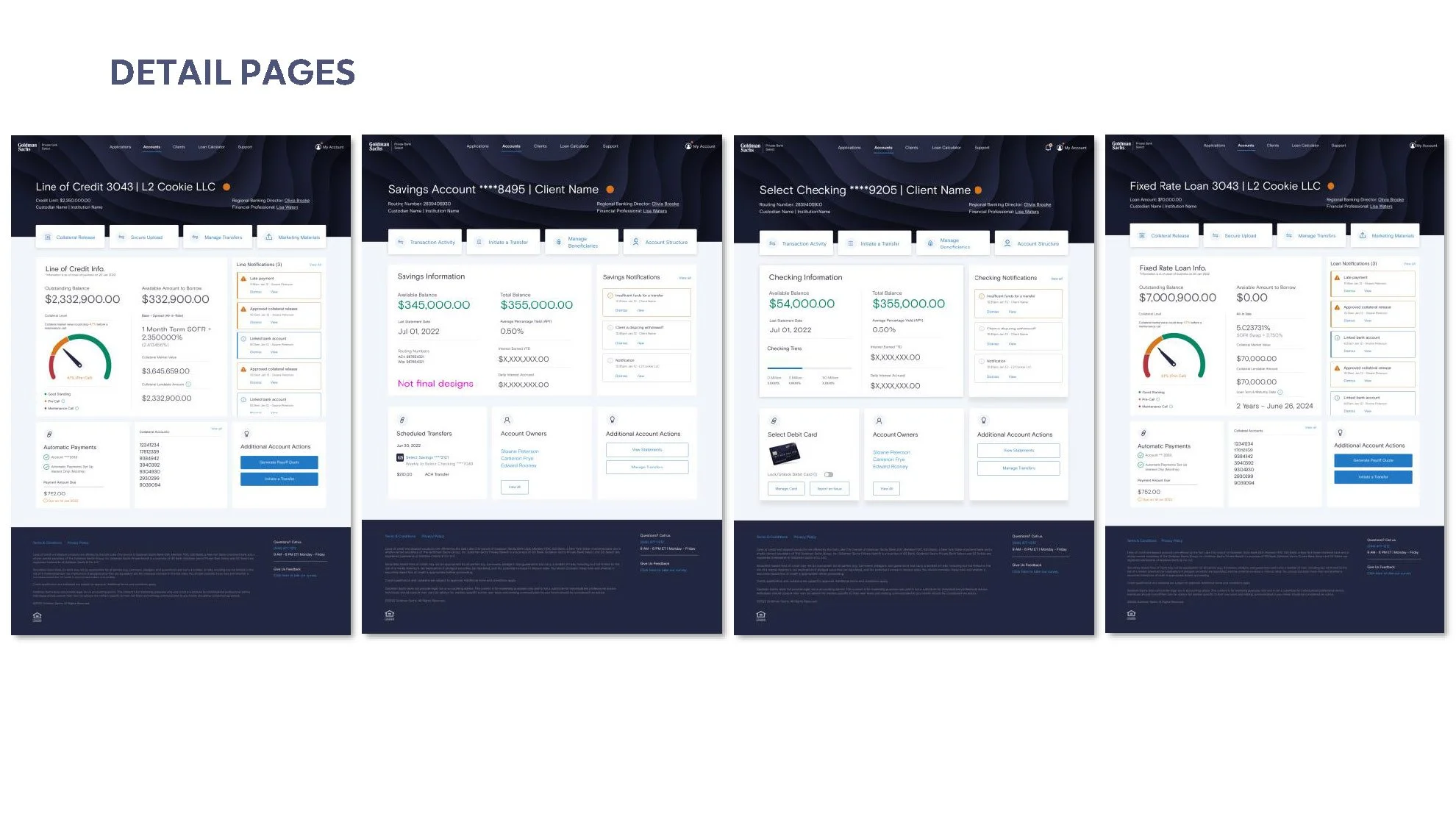

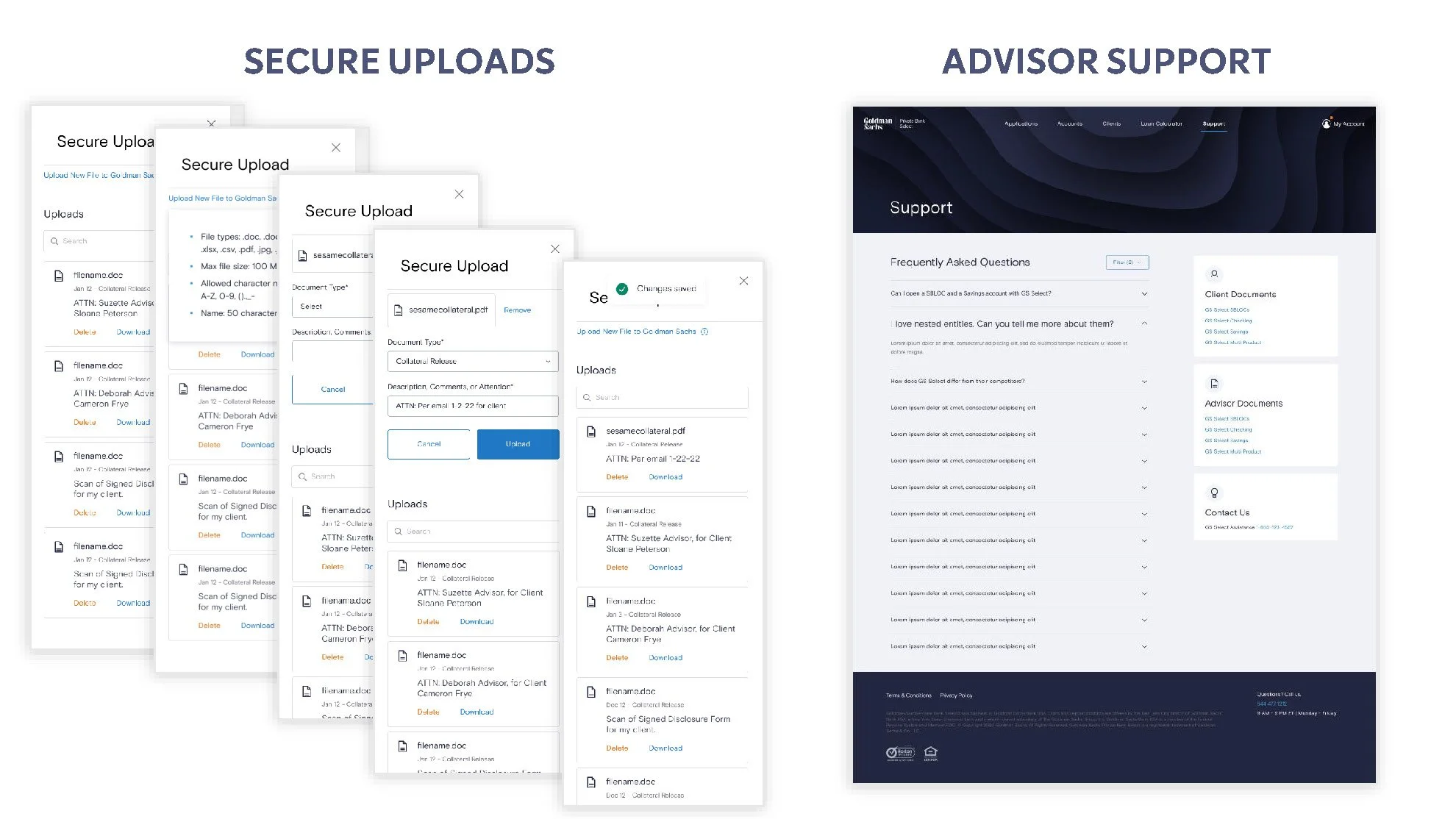

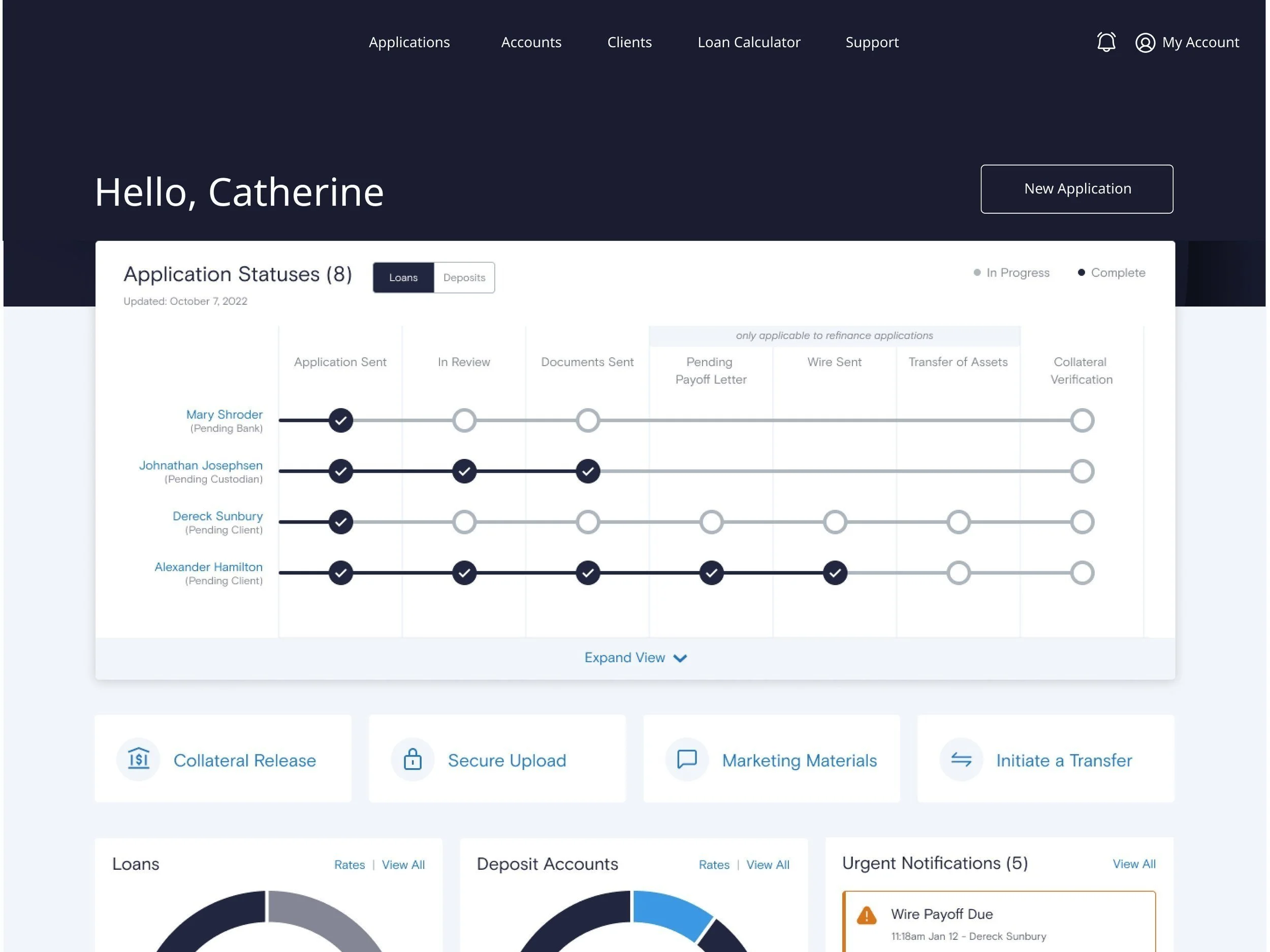

Advisor Portal Experience

We developed a comprehensive financial advisor experience aimed at providing advisors with a bird's-eye view of their clients' applications and accounts, enabling them to dive into finer details when needed.

The advisor dashboard offers a convenient summary of managed applications, clearly indicating pending actions and responsible parties. To further enhance efficiency, we collaborated closely with financial advisors to identify high-priority and frequently performed tasks, resulting in the integration of quick action buttons at the top of the dashboard for swift and easy access to critical functions.

-

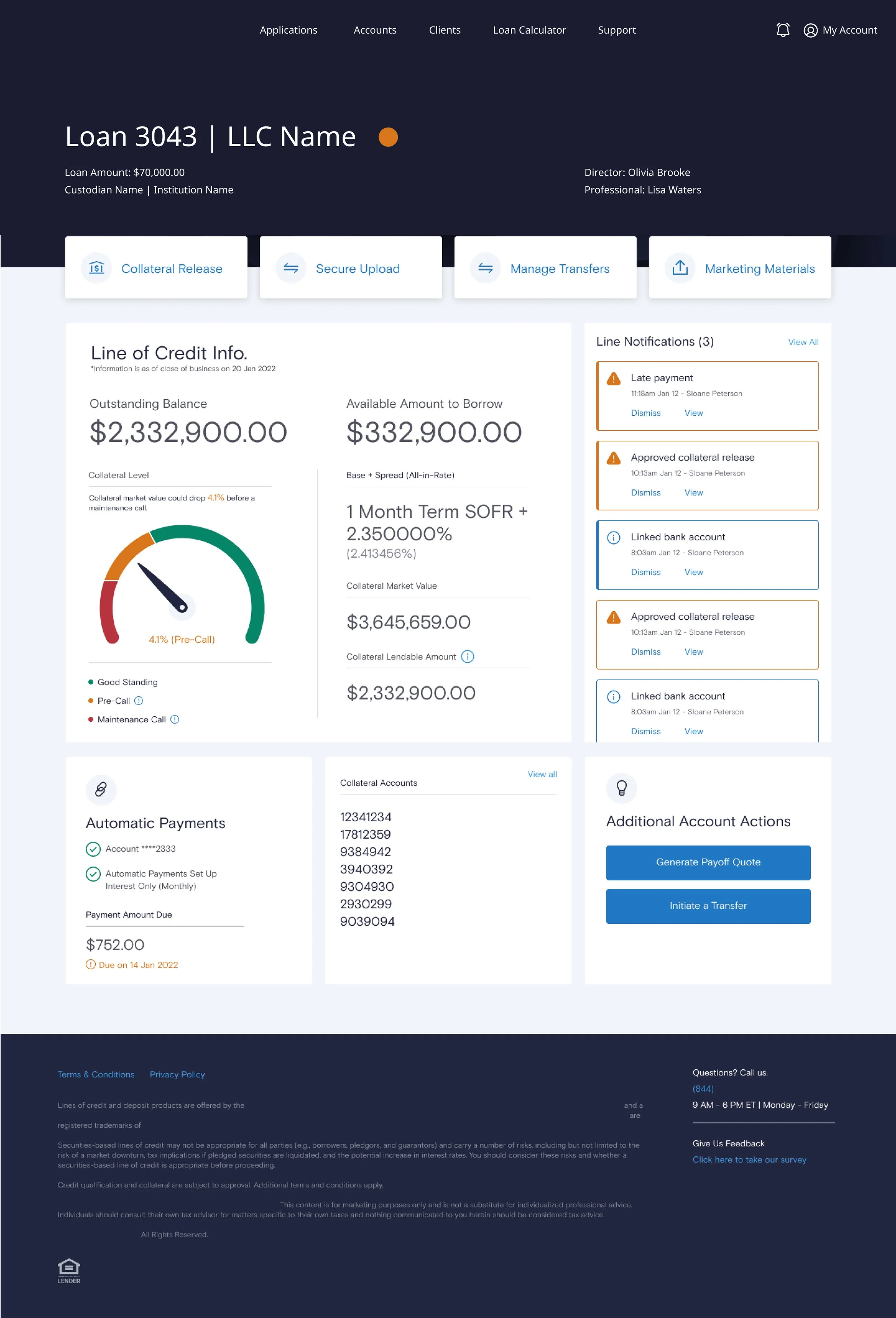

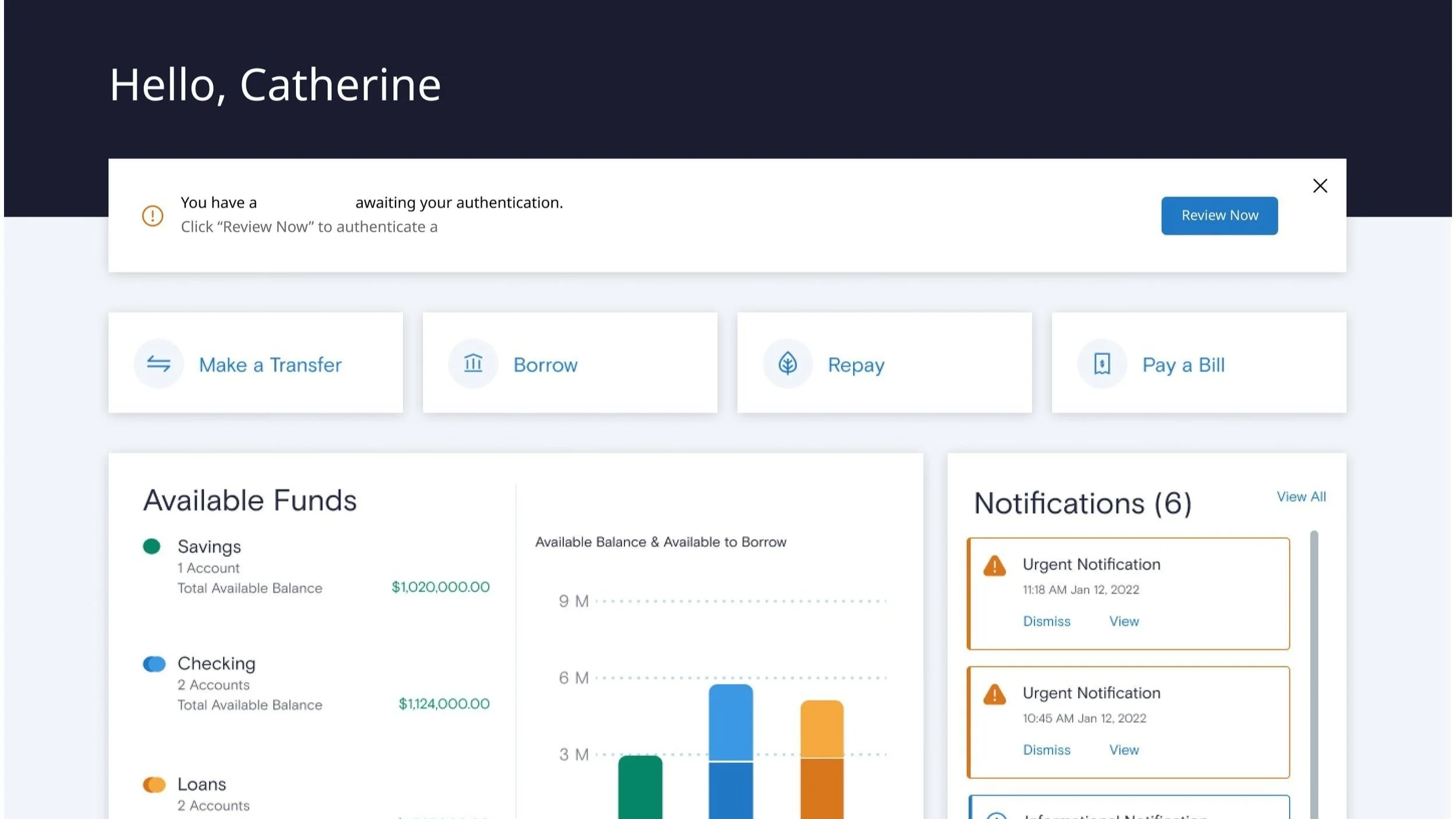

Client Portal Experience

The design approach for this project created a seamless and comprehensive dashboard experience. Users can find quick actions at their fingertips to efficiently accomplish tasks, like managing their overall portfolio with the firm and approving advisor-initiated money movement.

The design seamlessly accommodates both web and mobile navigation, ensuring a consistent experience. Users have a centralized hub to access statements, monitor the status of their checking and savings accounts, and easily seek support, including FAQs and direct communication with their advisors, when needed.

-

Marketing Website

At the end of the engagement, we created a marketing website driven by a visionary concept characterized by blue-sky thinking. It's designed to encompass not only the company's latest product offerings, but also a refreshed and modernized brand identity.

The primary goal is to offer streamlined user experiences to both existing and potential clients and financial advisors. This holistic approach aims to elevate the company's online presence, providing a comprehensive platform for showcasing its products and services while presenting a user-friendly interface that aligns with their innovative vision.